The following article is an overview of “Powering Data Centers,” a report from Jefferies’ Equity Research Team. For the full report, visit this link.

If it feels like GPUs (Graphics Processing Units) are suddenly everywhere, it’s because they are. GPUs drive computation across a wide range of industries and applications, from big data analytics to machine learning.

Soaring GPU demand is rippling across the global economy, but no area has been more affected than data centers. They house the infrastructure to power, cool, and manage GPUs. Over the past two years, data center demand has skyrocketed, surging to over 30% annual growth in some key markets.

The pressing question is: Can supply keep up? Market constraints — including scarce raw materials, limited land, labor shortages, and construction bottlenecks — pose serious challenges. Most critically, power generation and grid capacity are lagging.

With demand outstripping supply, rents for wholesale data centers have jumped over 80% since late 2021, reversing years of decline. Rising build costs further strain the market.

This explosive growth in data centers, coupled with infrastructure and power constraints, presents both challenges and opportunities for a myriad of sectors, including utilities, energy, capital goods, infrastructure/construction, and more.

A new report led by Jefferies Utilities and Clean Energy team, with input from more than 20 Jefferies analysts around the world, explores the implications of this growth, the economic dynamics, and the strategic moves needed to sustain the sector’s expansion.

This article previews the following areas of the report:

- Data Center Power Consumption

- Renewable Energy and Power Purchase Agreements

- Regional Dynamics and Opportunities

Data Center Power Consumption

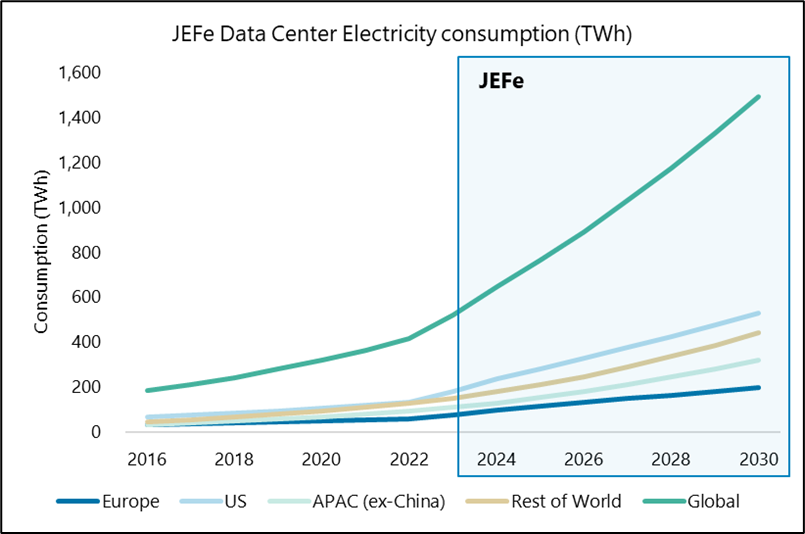

AI Data centers are large, energy intensive operations that often run 24 hours a day. Since 2016, their global power consumption has grown at an estimated 16% compound annual growth rate (CAGR). Jefferies projects this growth will continue through 2030, with US data center electricity consumption outpacing that of Europe and APAC (excluding China).

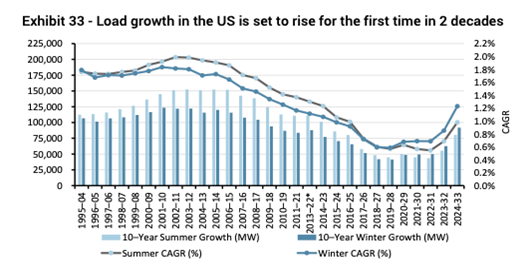

In the US, many regulated utilities, grid planning organizations, and industry consultants are forecasting resurgent energy demand growth over the decade. This growth could strain power generation and grid capacity. Ten years ago, 15% demand growth in the data center market meant about 250 megawatts. Today, the same growth equates to 2 gigawatts — eight times the demand — and growth was double that in 2022 and ‘23.

In Europe, electricity demand has been flat for two decades, remaining at 2000 levels through 2023. It’s now poised for a rebound, expected to grow at 2-3% annually. Data centers will be a major driver, potentially accounting for 20% of this future growth.

Source: Jefferies Estimates, DC Hawk

Renewable Energy and Power Purchase Agreements

One beneficiary of the data center boom may be the global energy transition.

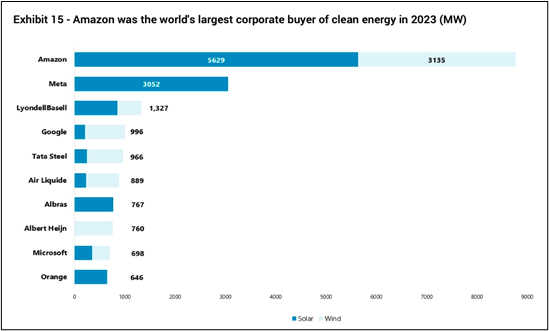

The growth in data centers is expected to help renewable power developers reduce risk by allowing them to form longer-term contracts at higher prices. Big tech companies are now major buyers of Power Purchase Agreements (PPAs) for renewable energy, with contracts spanning 10-15 years at fixed or variable prices. These firm revenue commitments enable developers to finance new renewable energy projects. As data center demand grows, so will these agreements. In 2023, the corporate PPA market hit a record high for the seventh consecutive year, with an increasing share going toward solar, wind, and other renewable sources.

Source: BNEF, Jefferies Analysis

Regional Dynamics and Opportunities

In the United States, resurgent electricity demand from data centers will require additional transmission and generation infrastructure investments in the US. Companies in these spaces are expected to benefit more than those focused on distribution. Independent power producers and nuclear plants will also profit from increased power demand, with nuclear power particularly valued for its stable, carbon-free electricity. Broadly, US utility capital expenditure can be split into three buckets: (1) Grid Hardening, or investments in grid reliability and resistance against adverse weather conditions; (2) Generation, including solar, nuclear, and peaker gas; and (3) Transmission & Distribution, or enhancing and expanding the system around power delivery.

Source: Long-Term Reliability Assessment 2023, FERC, Jefferies

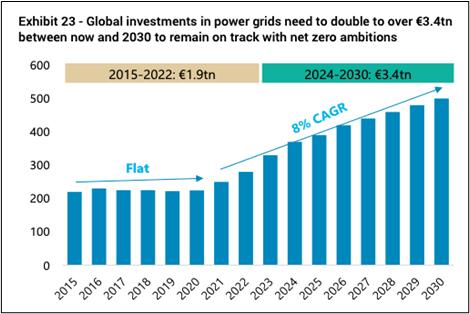

In Europe, the highest data center capacity growth is expected in Germany, Ireland, Spain, Italy, and Norway, with projections exceeding 15% CAGR over the next decade. Norway and Spain, with their cheap baseload power, are attractive markets for incremental data center demand. Germany, Ireland, the Netherlands, and the UK, with their strong financial services, tech companies, and advanced internet and wiring infrastructure, are also prime candidates for this growth. The challenge is the age of European grid infrastructure: 40% of EU grids are over 40 years old. To address these vulnerabilities, European grid companies are significantly increasing their capital expenditure. This increase is driven by new power plant connections, grid resilience improvements, reinforcements, and maintenance. However, developing the necessary infrastructure could take years due to regulatory and permitting processes.

Source: Rystad Energy, Jefferies Cap Goods Team Estimates

In India, the data center market is rapidly expanding, spurred by the Reserve Bank of India’s directives to localize payment data. The country’s data center capacity is projected to grow at over 50% CAGR. This growth necessitates a significant rise in power generation and T&D investments, expected to increase 2.2 times to $280 billion by 2030. This expansion positions India as a major hub for data centers, driving both economic growth and substantial capital expenditure in the sector.

In China, data center power consumption is projected to reach nearly 8% of total power usage by 2030. AI development – particularly generative AI and large language models – are driving rapid growth. Concurrently, China’s grid infrastructure is set to expand significantly. The country is investing in digitalization and distribution to support renewable energy growth.

As the AI era roars on, GPUs and data centers will remain key drivers of global economies. The demand growth brings significant challenges but also vast opportunities. For a more in-depth look at how data center and electricity demand growth will impact global markets, sectors, and governments, read the full report from Jefferies’ Equity Research Team here.